What does it mean when a Workday supplier record is on hold?

“Hold” status in Workday means a supplier’s information is not complete and needs to be reviewed and updated with the correct tax forms. Unlike an “inactive” status, the “hold” status does not currently suspend procurement or payment activities. It is a useful reminder that information for the payee needs to be updated.

When entering into agreement with a supplier, it is important to have the payees’ correct Taxpayer Identification Number (TIN) and Tax Form, to ensure WSU is in compliance with IRS regulations.

Whether the supplier is in the United States or a Foreign Individual/Entity determines which tax form they need to fill out.

- Form W9 is used by payees that are created and organized primarily in the United States

- Form W8-BEN is used by nonresident payees (i.e. visa holders)

- Form W8-BEN-E is used by foreign business entities

This is also a good opportunity to make sure payee contact information, such as address, phone number, email address, and payment method preference is updated on the Workday supplier record. Most suppliers prefer to be electronically paid, rather than by check, which reduces the time to receiving a deposit.

Below are the steps to review a supplier’s tax forms:

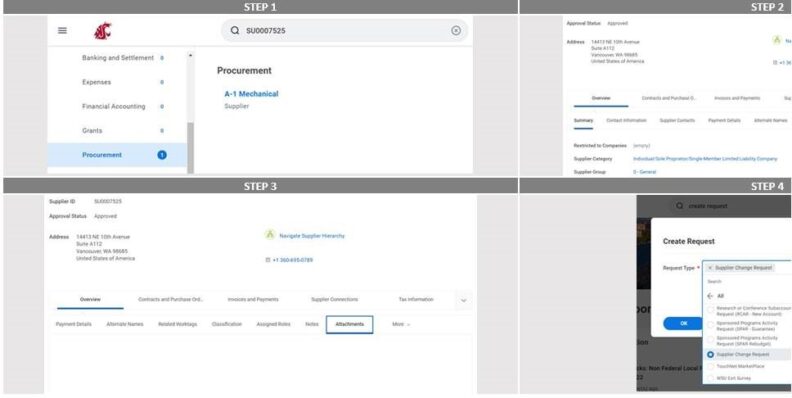

- Search for the supplier in Workday and open the supplier record.

- Under the Overview tab, select the Summary tab. There you will see the supplier category.

- Under the Overview tab, select the Attachments tab. There you will find any tax documents that have been received for the supplier. You can view these documents by selecting each one.

- If you have received tax documents from the supplier and would like to add them to their record, you will need to create a supplier change request. Learn how to submit a supplier change request using this reference guide.

Questions may be submitted to the Workday Service Desk.