Validating beginning balances in Workday

Reconciling beginning balances between Workday and legacy systems

Tools used – Workday, OBIEE, and the financial data warehouse (webi)

Overview – Beginning balances in Workday were derived by extracting legacy accounting activity, cross-walking it using the OBIEE conversion tables, and then loading it into Workday using the new FDM values. This can be reconciled by pulling data warehouse reports, translating the data to the appropriate worktags using OBIEE, and comparing it to available Workday reports. An article about finance data availability can be viewed here.

Steps:

1. The first step to reconciling beginning balances in Workday is to identify the worktag you want to validate. OBIEE will help you identify the appropriate worktags, you can filter on any of the worktags using the filter options in OBIEE. This can be done at a high level, such as a cost center/cost center hierarchy, or it could be a lower level such as an individual program. The comparison could range from one legacy budget-project if you are checking one program, or the comparison could be hundreds of budget-projects if you are checking a large cost center hierarchy. Identifying which worktag you are validating is an important step to help you prepare the appropriate data warehouse reports.

2. After you have identified the worktag(s) you want to validate, it is time to identify and run the appropriate report in the data warehouse. As referenced in step 1, the report may differ depending on your validation. A single program can often be validated using a standard budget statement report from the warehouse, but validating a whole cost center may require a more advanced report to pull in data for a whole series of legacy accounts. To validate beginning balances in Workday, you will want to bring in accounting activity from 7/1/2020-12/31/2021.

| Account_ Coding_Text | Fund-Subfund | WORKDAY_ COSTCENTER | WORKDAY_ PROGRAM | WORKDAY _FUND | WORKDAY_ FUNCTION | Expenses from FDW |

| 001-01-01E-1216-0001 | 00101 | CC0421 | PG00005353 | FD001 | FN044 | $15,917.70 |

3. Now that you have your data warehouse report cross-walked to Workday values, you should run your Workday budget to actuals reports to get Workday data for comparison. Pick the appropriate budget to actuals report depending on the worktags you are validating, keeping in mind core vs non-core when comparing.

4. Compare your cross-walked data warehouse report to the Workday report. A few things to keep in mind when comparing:

- If you are viewing a report with encumbrances/commitments/obligations, the numbers may not reconcile to the penny. These items are handled different in Workday than they were in legacy systems, which leads to some discrepancies. This should not cause any concern.

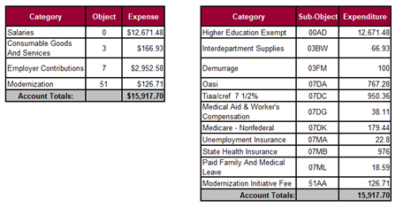

- While legacy reports generally show summaries at the object/sub-object level, Workday reports will show summaries by ledger account. Workday ledger accounts are not always exactly the same as legacy object/sub-object, there may be some differences in how they are broken up. For example, salaries and wages were separate objects in legacy systems (object 00 and 01), but they are now combined into ledger account 5000: Salaries and Wages.

Recommended Reports:

- CR FIN Core Budget to Actuals Summary

- CR FIN Non-Core Budget to Actuals Summary

Troubleshooting – Things to try if it is not validating as expected:

- Is there more than one legacy budget-project converting to the worktag in question? Double check that you have included all budget-projects that are included in the worktag you are validating.

- There are some differences in how object 03 is converted to WD in terms of ledgers. Review all 6000 (expense) ledgers together (purchased services, goods and services).

- If the worktag you are trying to reconcile includes salaries/wages, please remember that Payroll expenses will be included for the second half of December in Workday. This will need to be considered when reconciling, as those expenses will not match legacy expense data for December.